Dive into an exciting journey to uncover how technology is revolutionizing the realm of financial inclusion, dismantling long-standing barriers, and paving the way for seizing unprecedented opportunities in the future.

Understanding Financial Inclusion

Financial inclusion is more than just a buzzword; it’s a gateway to empowering individuals and fostering economic equality across the globe. It’s about ensuring that every person has access to essential financial services—regardless of their financial background or where they live.

At its core, it embodies the principles of accessibility, affordability, usability, quality and suitability of financial products and services. Together, these components form the bedrock of financial inclusion, a goal that, when achieved, can significantly uplift individuals and, by extension, economies worldwide by providing equitable access to financial tools for growth and stability.

The Technological Revolution in Finance

The surge in Financial Technology (FinTech) has become a beacon of hope for enhancing financial inclusion across the globe. The innovative melding of technology with finance is revolutionizing the way financial services are delivered, making them more accessible, efficient, and affordable.

The digital revolution in finance is not just about technological advancement; it’s about creating a more inclusive financial system that empowers individuals and drives economic growth. As we venture further into this digital era, the possibilities for transforming finances are limitless, with FinTech at the helm steering us towards a more inclusive and prosperous future.

FinTech has introduced a plethora of technologies that serve as the backbone of this financial revolution:

- Mobile Banking: Emerges as a pivotal force, bringing banking services to the fingertips of users worldwide, especially in regions previously underserved by traditional banking.

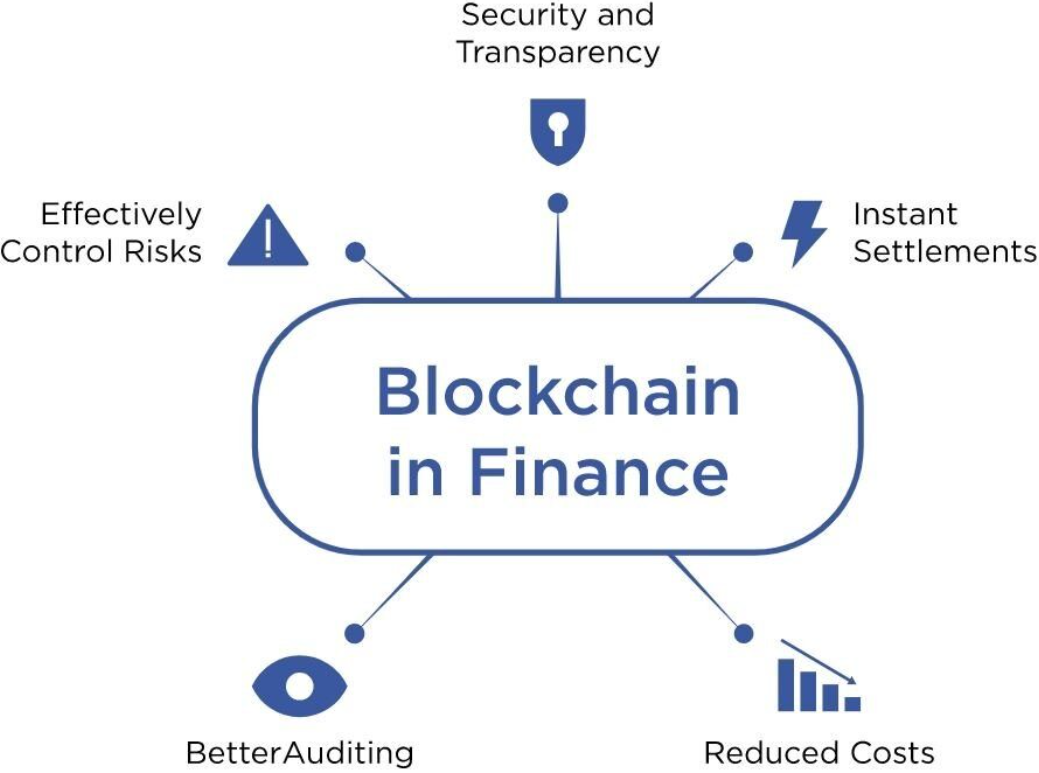

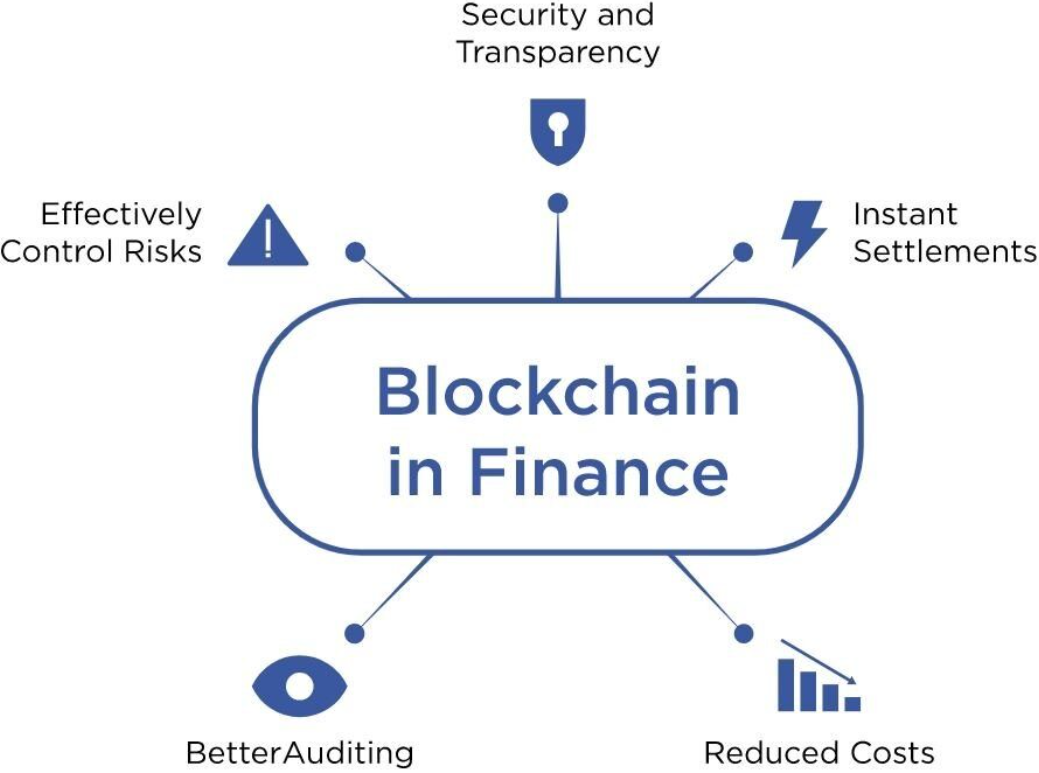

- Blockchain Technology: Offers a decentralized, secure, and transparent platform for financial transactions, significantly lowering costs and enhancing access.

- Digital Identification Systems: These systems provide a secure means for individuals to verify their identity online, simplifying the process of accessing financial services.

These technologies, along with others like Artificial Intelligence (AI) and Machine Learning (ML), are dismantling traditional barriers to financial services.

Case Study of Ant Financial – A Giant in Chinese FinTech

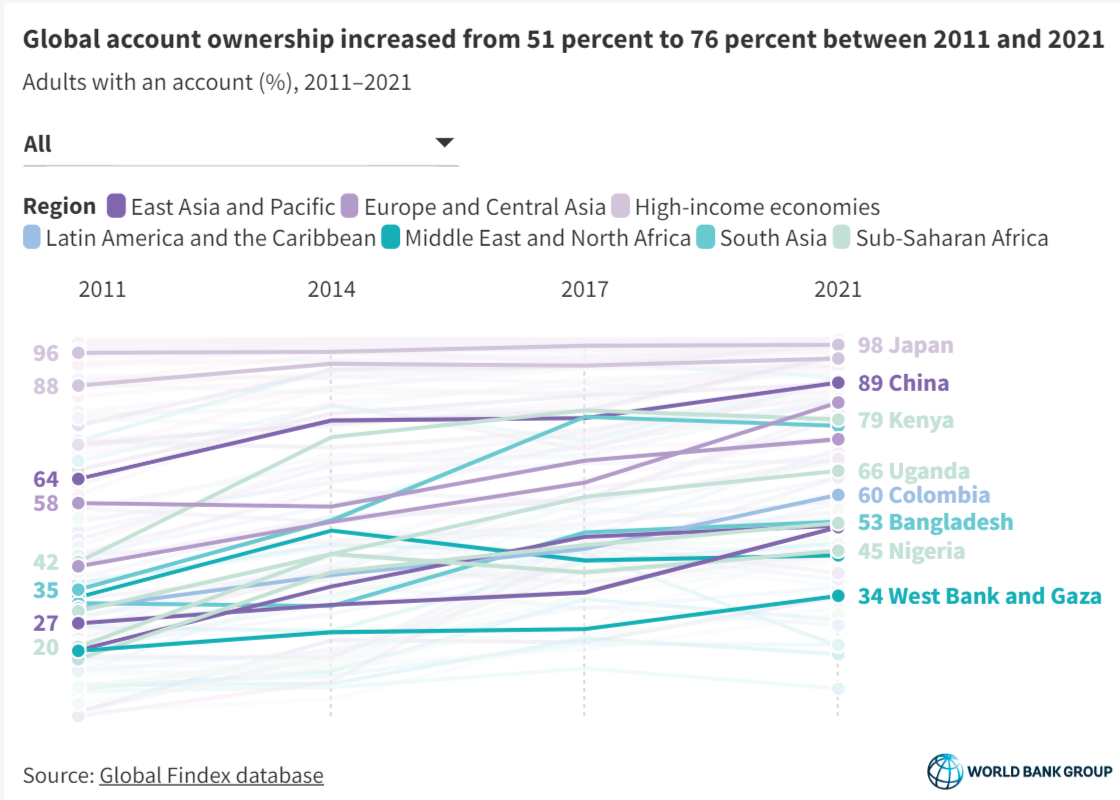

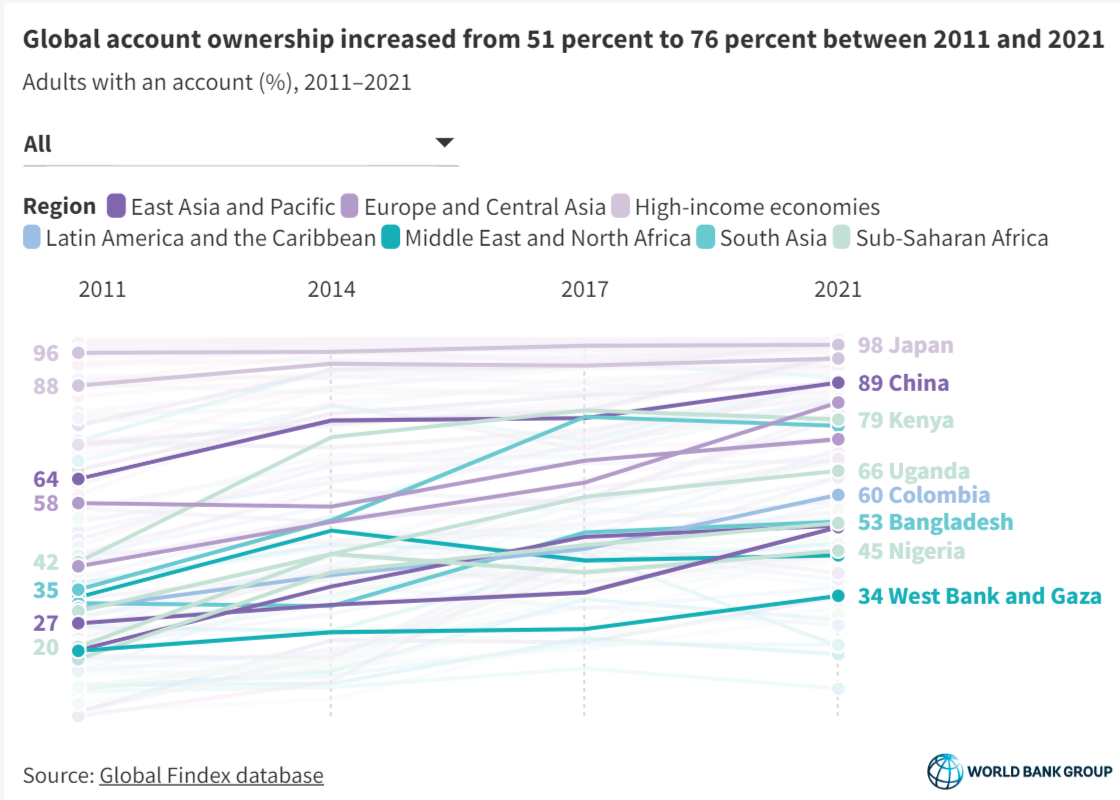

The World Bank Global Findex Database underscores the remarkable expansion of digital financial services, revealing that the share of adults worldwide with a financial account surged from 51% to 76% over the past decade, primarily propelled by the adoption of digital financial solutions. Experts assert that the adoption of digital financial services still has the potential to expand further.

Ant Financial, an affiliate of Alibaba Group, serves as a compelling case study, showcasing the importance of embracing and leveraging technological trends in the financial sector. It offers a suite of digital financial services significantly impacting China’s financial inclusion landscape. Its platforms, including Alipay, have redefined financial services in China:

- User Base: Ant Financial serves over 1 billion users globally with its digital payment platform, Alipay, being one of the world’s largest.

- Microloans Success: Through its MYbank subsidiary, Ant Financial has extended microloans to millions of small and micro-enterprises and entrepreneurs, many of whom were previously unbanked.

- Technological Innovation: Leveraging big data and AI, Ant Financial has been able to offer personalized financial services, thereby enhancing user experience and accessibility.

Future Trends and Predictions

The article “Bridging the financial divide: a bibliometric analysis on the role of digital financial services within FinTech in enhancing financial inclusion and economic development” showcases how FinTech innovations are creating a more inclusive financial ecosystem. Analyzing research from 2010 to 2023, it uncovers major themes, trends, and gaps in the field, and spotlights key authors, institutions, and journals driving this dynamic area of study.

Increased Interdisciplinary Research and Global Collaboration

The research highlights an increasing cross-disciplinary focus on FinTech and financial inclusion, indicating future studies will bridge diverse academic realms, integrating knowledge from economics, computer science, social sciences, and development studies.

This collaborative approach is vital for tackling the widespread issue of financial exclusion, impacting billions worldwide, particularly in developing nations. By forming global partnerships, FinTech projects can be tailored to various local environments, effectively addressing unique challenges to financial inclusion encountered by distinct communities.

Expansion of Mobile Banking and Digital Payment Solutions

Given the significant role of mobile technology and digital payments in enhancing financial access, particularly in underserved and unbanked populations, it is anticipated that these areas will continue to expand.

Innovations in mobile banking, peer-to-peer lending, and digital wallets are expected to evolve, driven by advancements in technology and a deeper understanding of user needs and behaviors.

Blockchain Technology for Financial Inclusion

Blockchain technology emerges as a promising area for future research and development, with potential applications in secure, transparent, and cost-effective transactions and record-keeping. The study’s findings suggest that blockchain could play a pivotal role in enhancing financial inclusion by facilitating more accessible financial services, improving data integrity, and reducing transaction costs.

Focus on Regulatory Frameworks and Consumer Protection

Future research is likely to delve deeper into how regulatory policies can adapt to support innovation in digital financial services while ensuring consumer protection, data privacy, and financial system stability. The need for a supportive and flexible regulatory environment that encourages the growth of FinTech while safeguarding against potential risks is highlighted.

It’s clear that the journey towards universal financial inclusion is being paved by technological advancements. Transforming your finances through technology is not just a possibility; it’s happening now, and it’s a global movement that promises to bring about lasting economic empowerment and prosperity for all.

How SmartDev can help companies to bridge the financial inclusions gap

SmartDev stands at the forefront of technological innovation, ideally positioned to help companies overcome the financial inclusion gap. With its cutting-edge technology and creative solutions, SmartDev transforms traditional approaches, enabling companies to reach underserved and unbanked communities effectively.

Here are some of the key services they provide:

🔑 Digital Payment Solutions

🔑 Digital Wallet Development

🔑 Blockchain Custom Development

In the fast-paced world of financial technology, staying ahead means breaking new ground with innovative solutions that meet the growing demands of a digitally savvy customer base. SmartDev is here to guide you through the technological revolution, ensuring that you’re not just adapting to the changes but thriving in them. Our team of experts specializes in developing innovative solutions that are tailored to meet your unique needs, driving growth and fostering financial empowerment.

Let’s work together to bridge the financial inclusion gap and create a more prosperous, inclusive future for everyone. Reach out now and take the first step towards transforming your financial services with the power of technology.