As we navigate through an era of unprecedented technological advancement, the banking sector is experiencing a profound transformation. Driven by the introduction of open banking, the emergence of neo-banks, and continuous innovations in financial services, this shift is not merely about keeping up with technology—it’s about reshaping the future of finance.

SmartDev’s recent webinar titled ‘Digitalization in Banking’ highlighted these transformative trends and showcased a success story of digital transformation in banking, emphasizing the critical role of digitalization in maintaining competitiveness and preparing for future challenges.

Meet the Experts

To provide deeper insights into the transformative trends in banking, the webinar featured a distinguished panel of experts, namely Dr. Lang Vinh Tuong, Dr. Geert Theys, and Dr. Yurii Lozinskyi, each boasting years of experience in the financial sector. These professionals have been pivotal in advancing open banking, leading digital transformations, and innovating within financial services. Their combined insights offered a comprehensive view of the ongoing trends and the future of digitalization in banking.

Figure 1: Webinar Host & Speakers

Understand Digitalization in Banking Concept

The digitalization trend in banking is characterized by the integration of advanced technologies such as AI, blockchain, and cloud computing, fundamentally altering how financial services are delivered and managed. This transformation has led to the emergence of new banking models, including digital banks and enhanced online services from traditional institutions, which focus on maximizing the efficiency of operations. As the trend continues, the entire banking landscape is evolving, with a strong emphasis on technological adoption to meet changing consumer expectations and regulatory demands.

Digital Banks

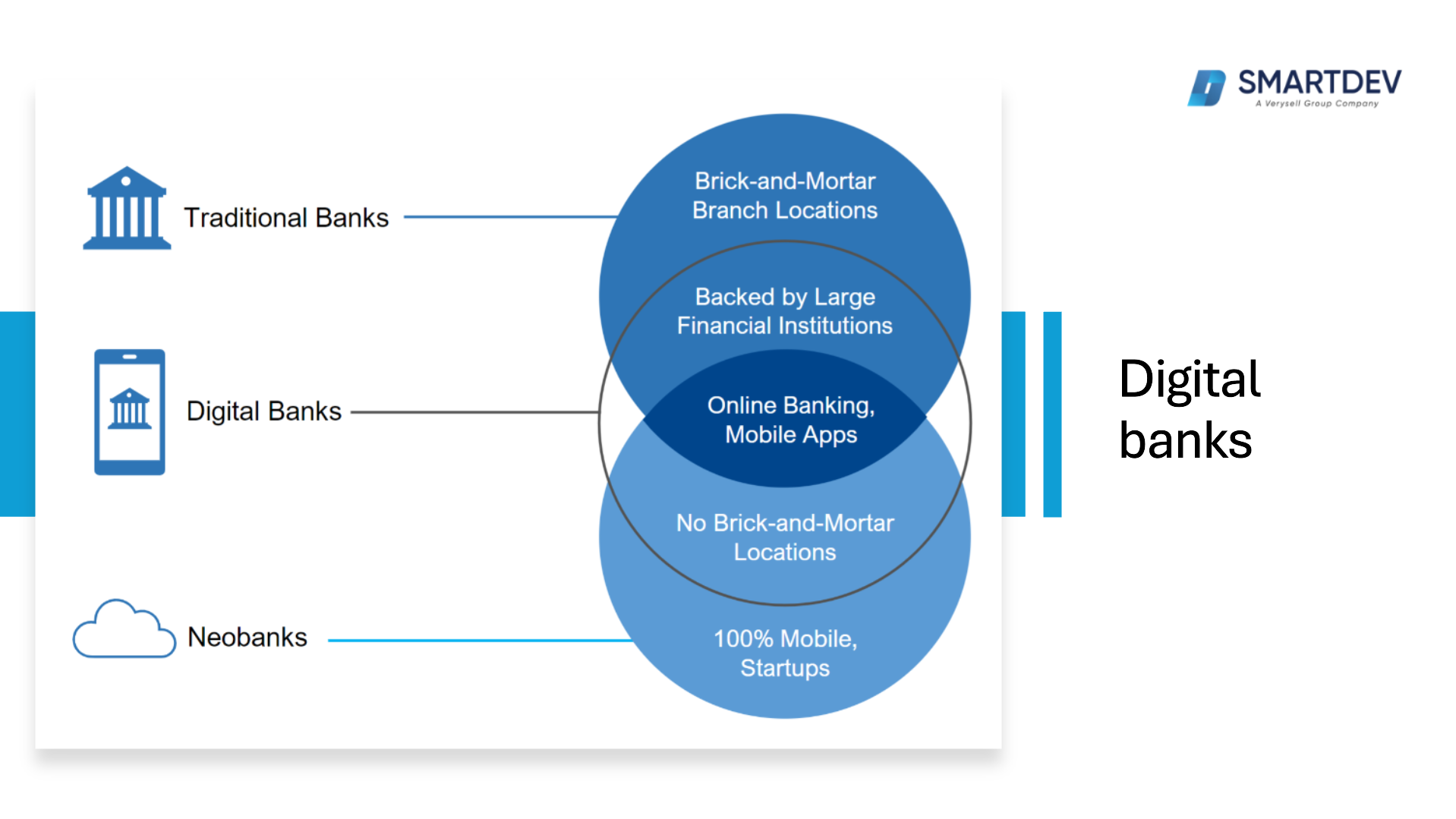

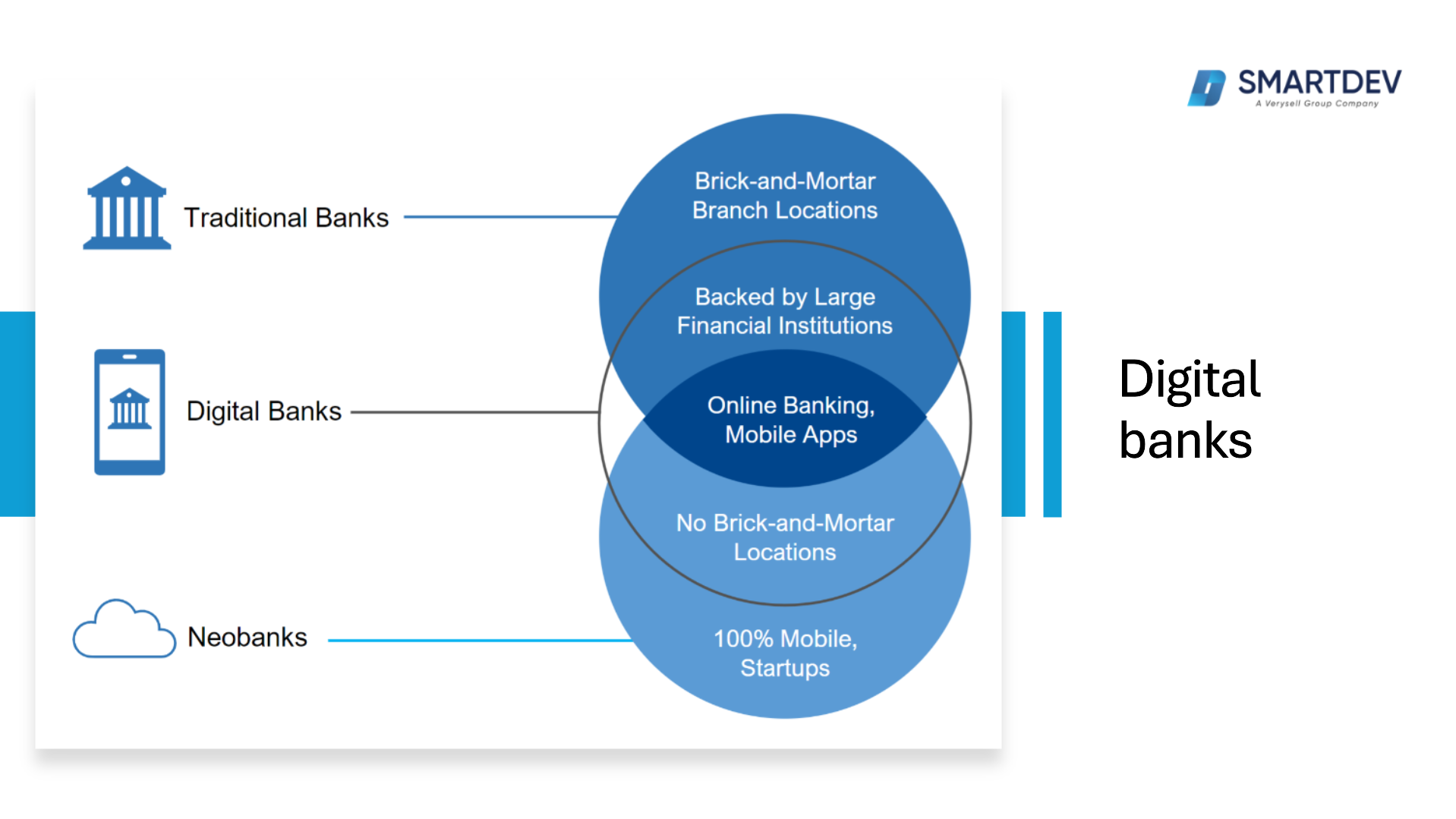

Geert started the discussion by outlining the differences among traditional banks, digital banks and neobanks. Traditional banks operate through extensive physical branch networks where customers can conduct transactions in person. Neobanks are a type of digital bank that operate exclusively online without any physical branches. Meanwhile, digital banks are financial institutions that offer traditional banking services exclusively through digital platforms like mobile apps and websites, without physical branch networks. They are typically part of an existing, traditional bank’s extension into the digital space, or an entirely new entity established to operate digitally. These banks are fully licensed and regulated under the same standards as traditional banks but leverage technology to streamline operations, reduce costs, and enhance customer experiences.

Figure 2: Types of Banks

This shift towards digital-only platforms is driving traditional banks to innovate and adapt, accelerating the overall digital transformation of the financial sector.

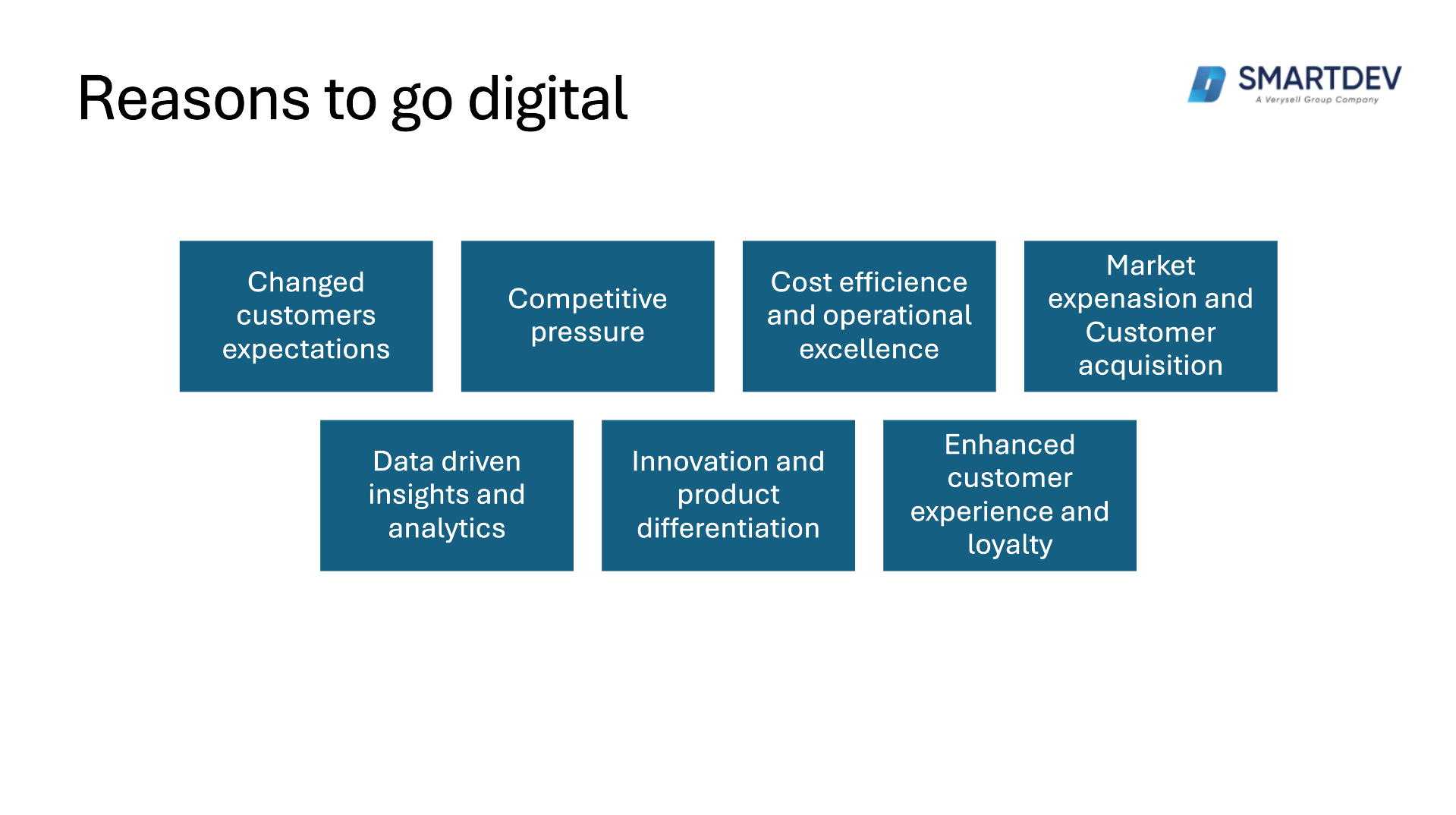

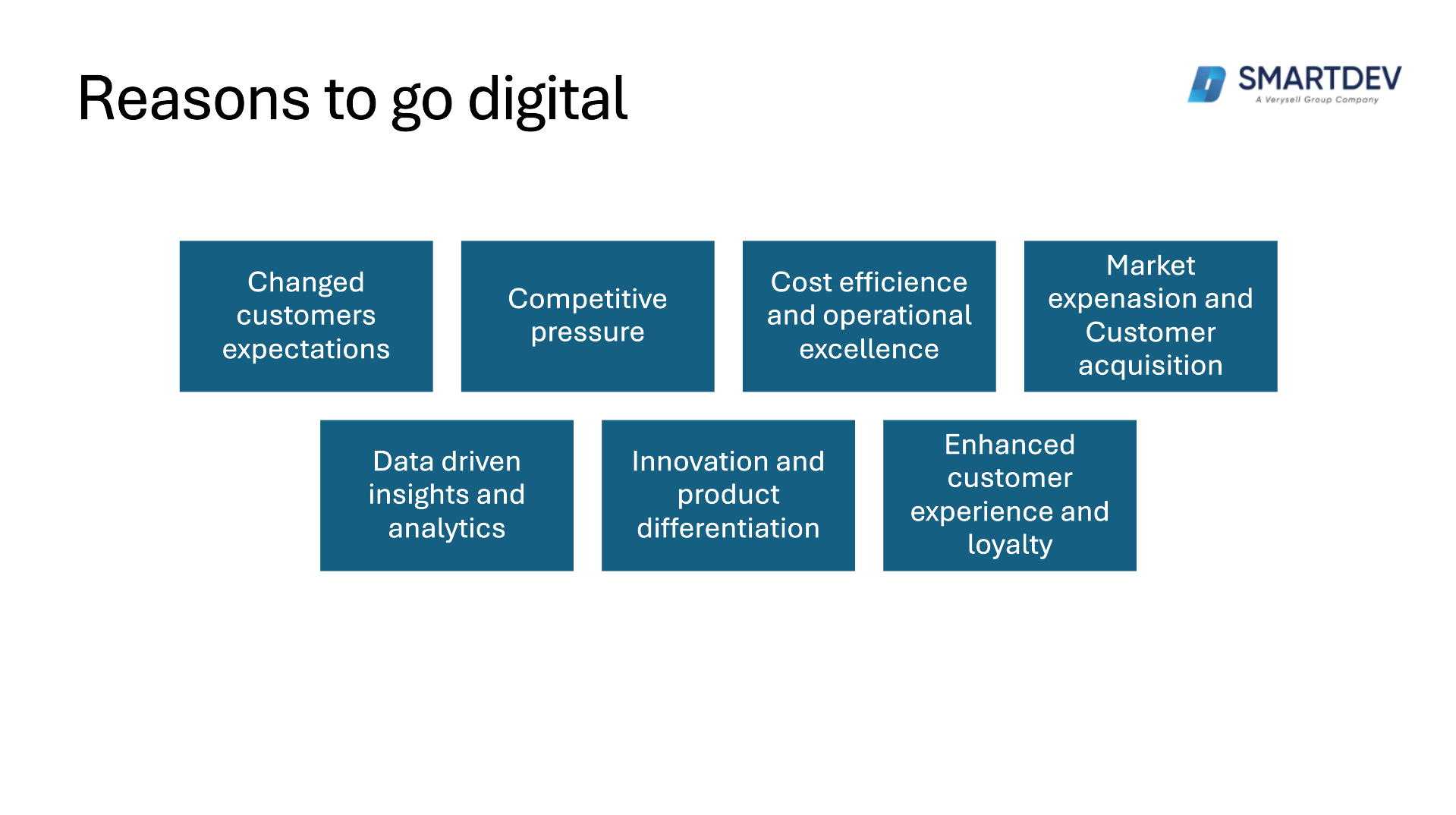

Reasons to Go Digital

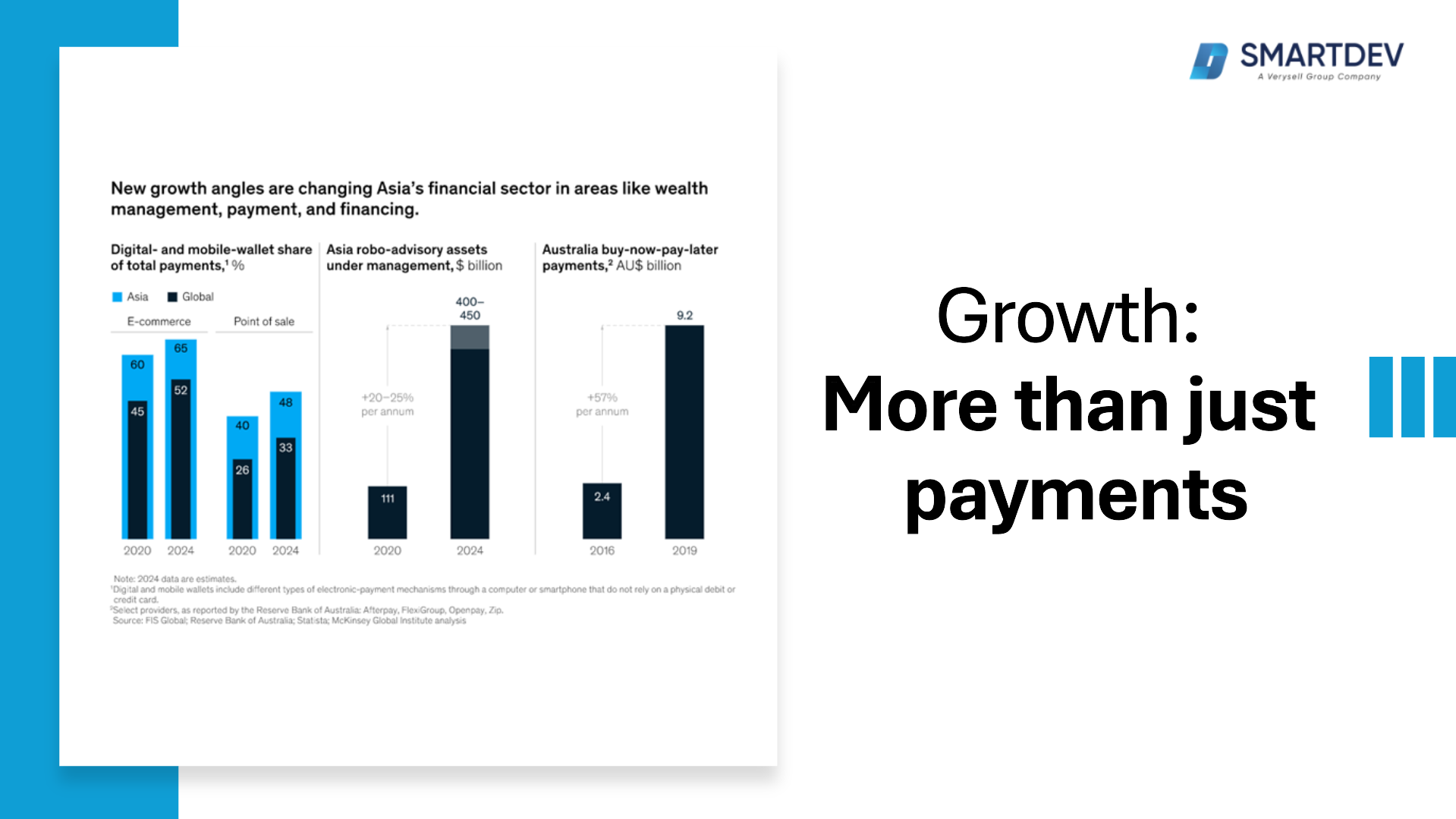

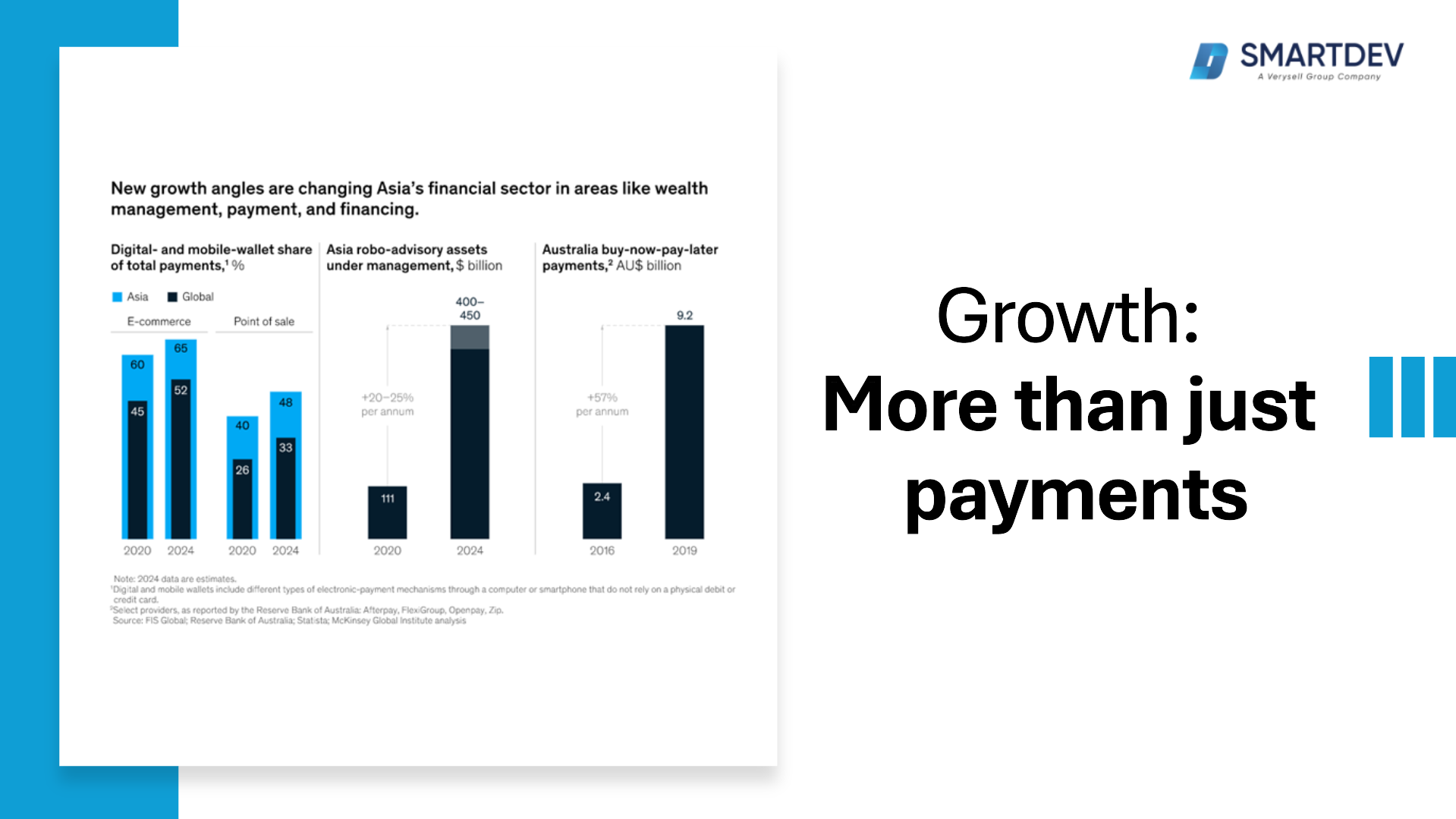

The shift towards digital banking is primarily driven by the evolving expectations of consumers who demand speed, convenience, and accessibility in their banking interactions. In an increasingly connected world, customers expect to perform financial transactions and access services instantly and from anywhere, using their mobile devices or computers. Digital banking meets these demands by enabling users to manage their accounts effortlessly, apply for loans online, and use digital payment solutions that align with their lifestyle needs.

Figure 3: New Growth Angles in Asia’s Financial Sector

Geert emphasized that the push for digital transformation in banking is motivated by the need for operational efficiency and cost reduction. Traditional banking systems, with their extensive physical branch networks and manual processes, are often costly and less efficient. By adopting digital solutions, banks can automate routine tasks, streamline operations, and reduce overhead costs, which in turn can lead to more competitive pricing and better rates for customers.

Figure 4: Digitalization Benefits

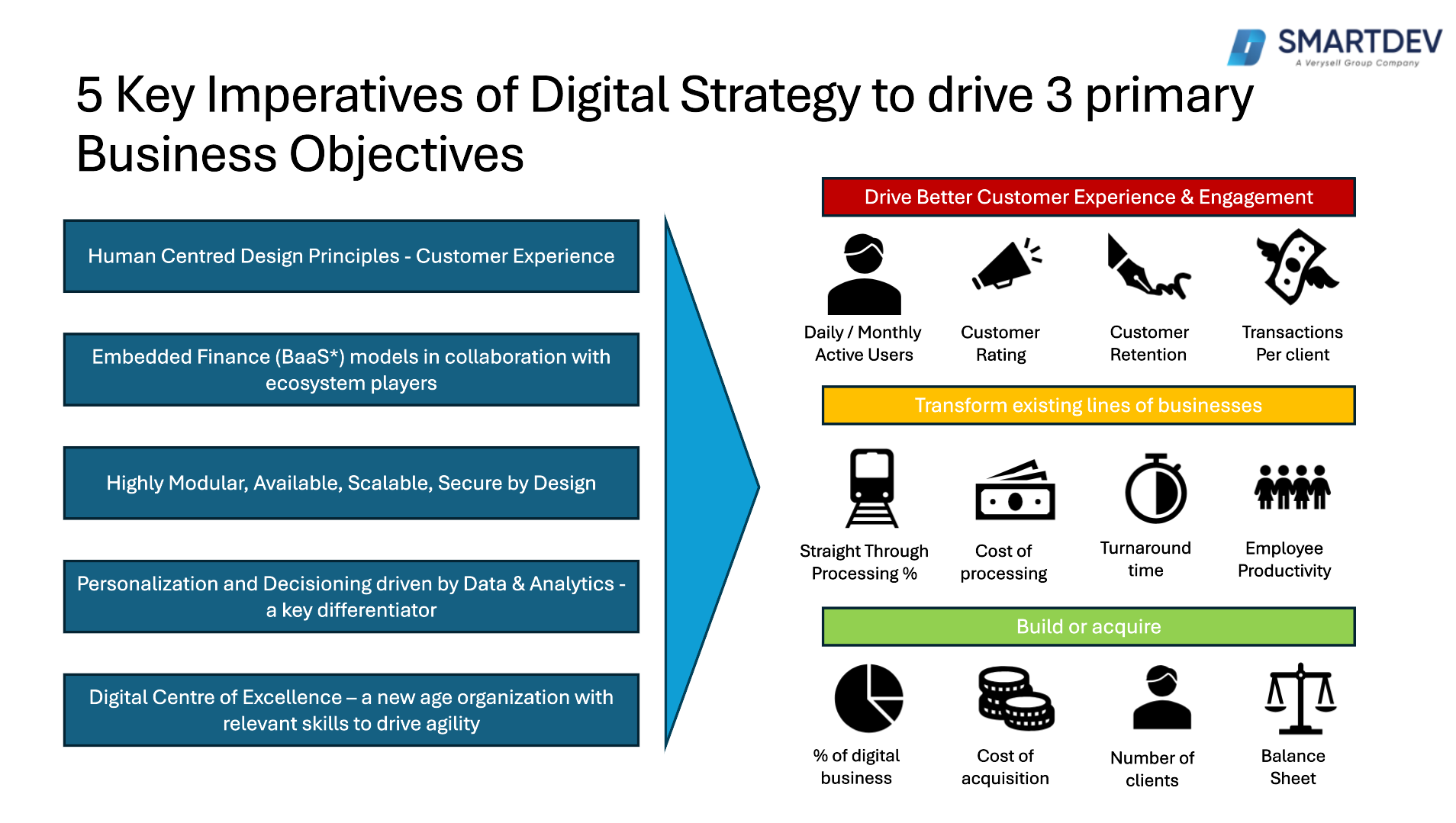

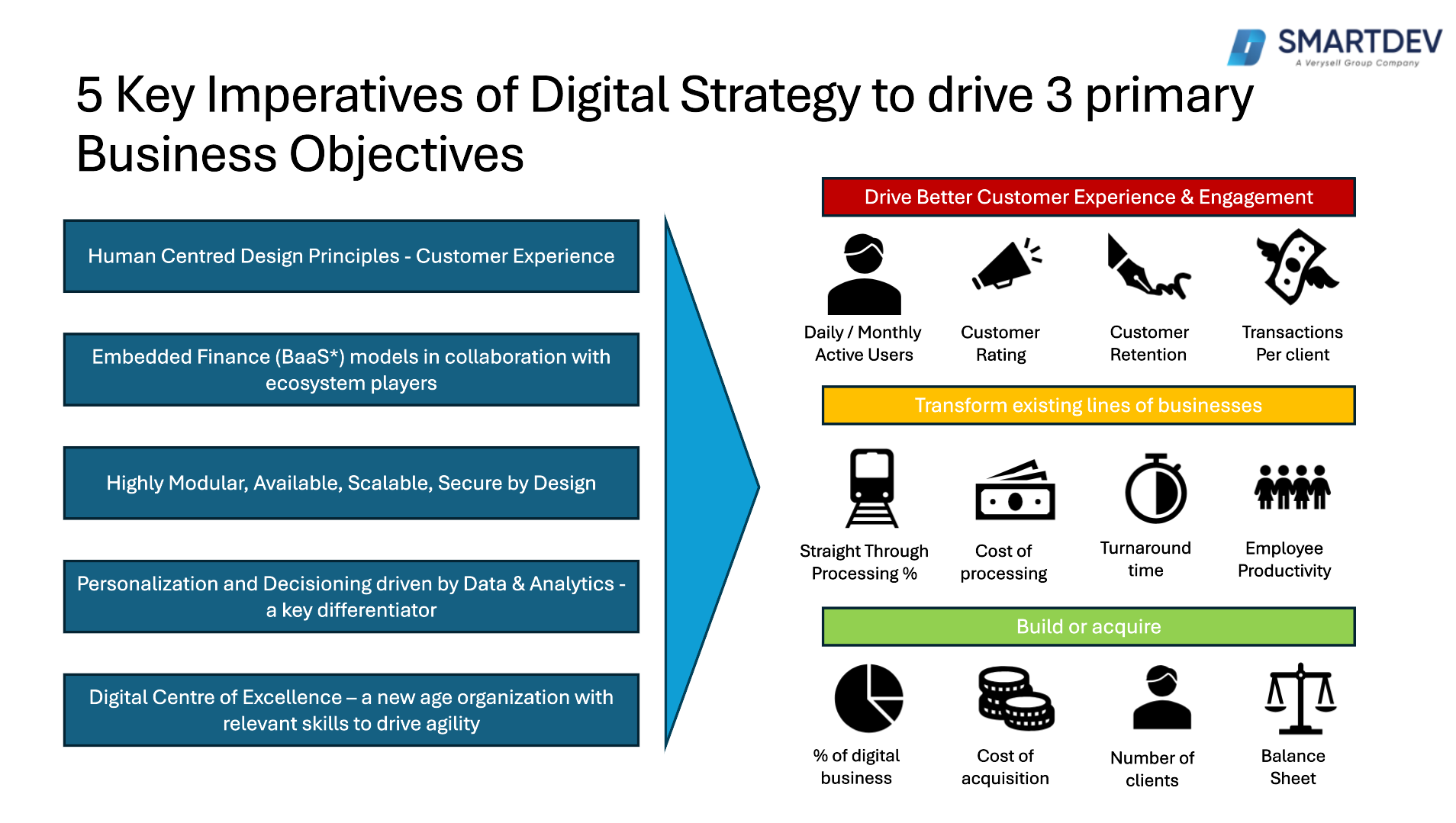

5 Key Imperatives of Digital Strategy

Figure 5: Key Imperatives of Digital Strategy

The five key imperatives of a digital strategy are essential guidelines that banks must follow to successfully navigate the digital landscape. According to Geerts, these imperatives form the backbone of effective digital transformation. By mastering these areas, banks can ensure they are not only adapting to the current landscape but are also positioned to lead in innovation, deliver exceptional customer experiences, and maintain a competitive edge in an increasingly digital marketplace.

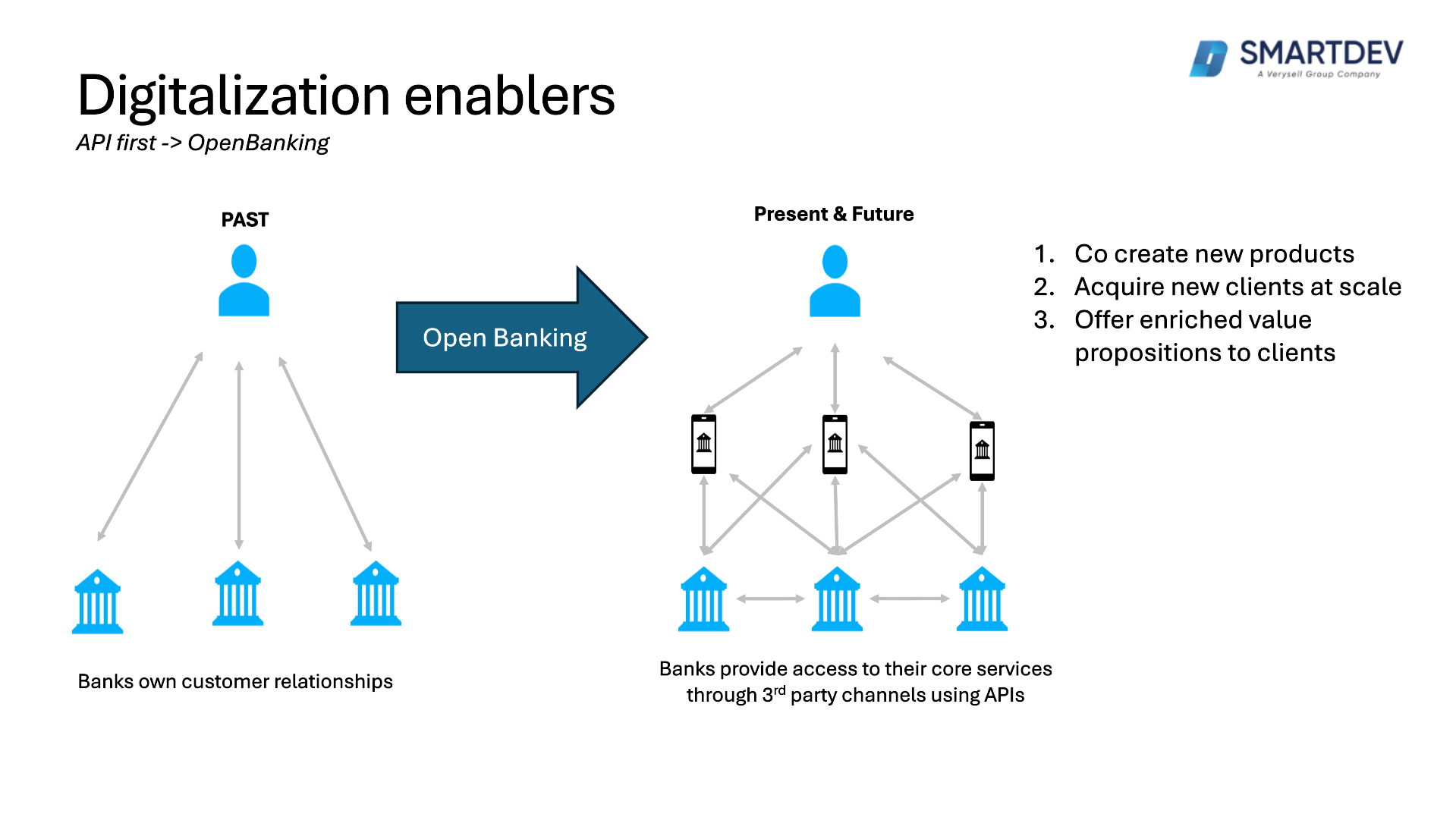

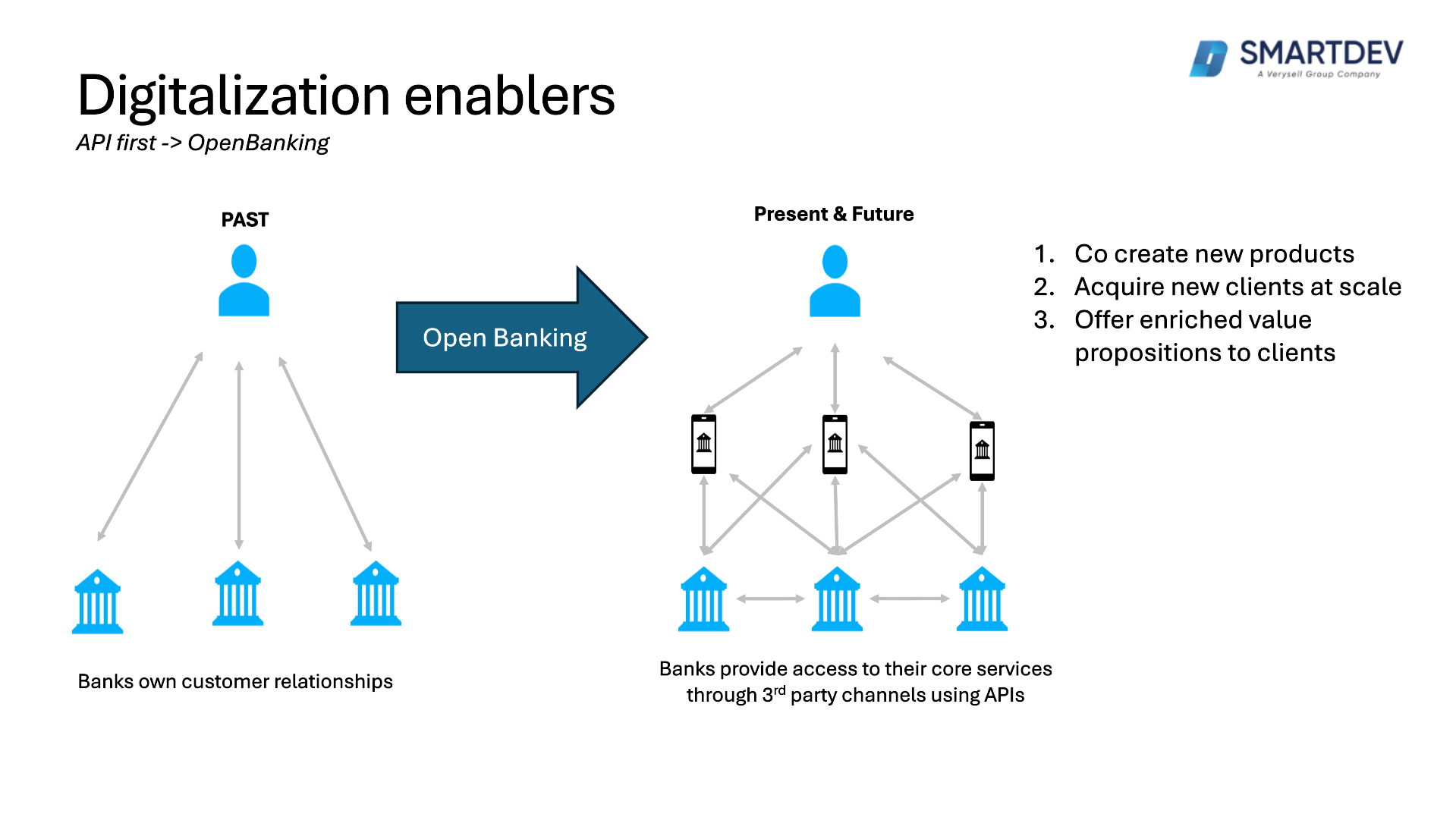

Digitalization enablers

APIs facilitate seamless integration and communication between different software applications, allowing banks to offer more interconnected services and a better user experience. Open Banking, enabled by APIs, pushes this boundary further by allowing third-party developers to build applications and services around the financial institution, fostering innovation, enhancing service delivery, and ultimately providing consumers with more control over their financial data.

Figure 6: Changes with Open Banking

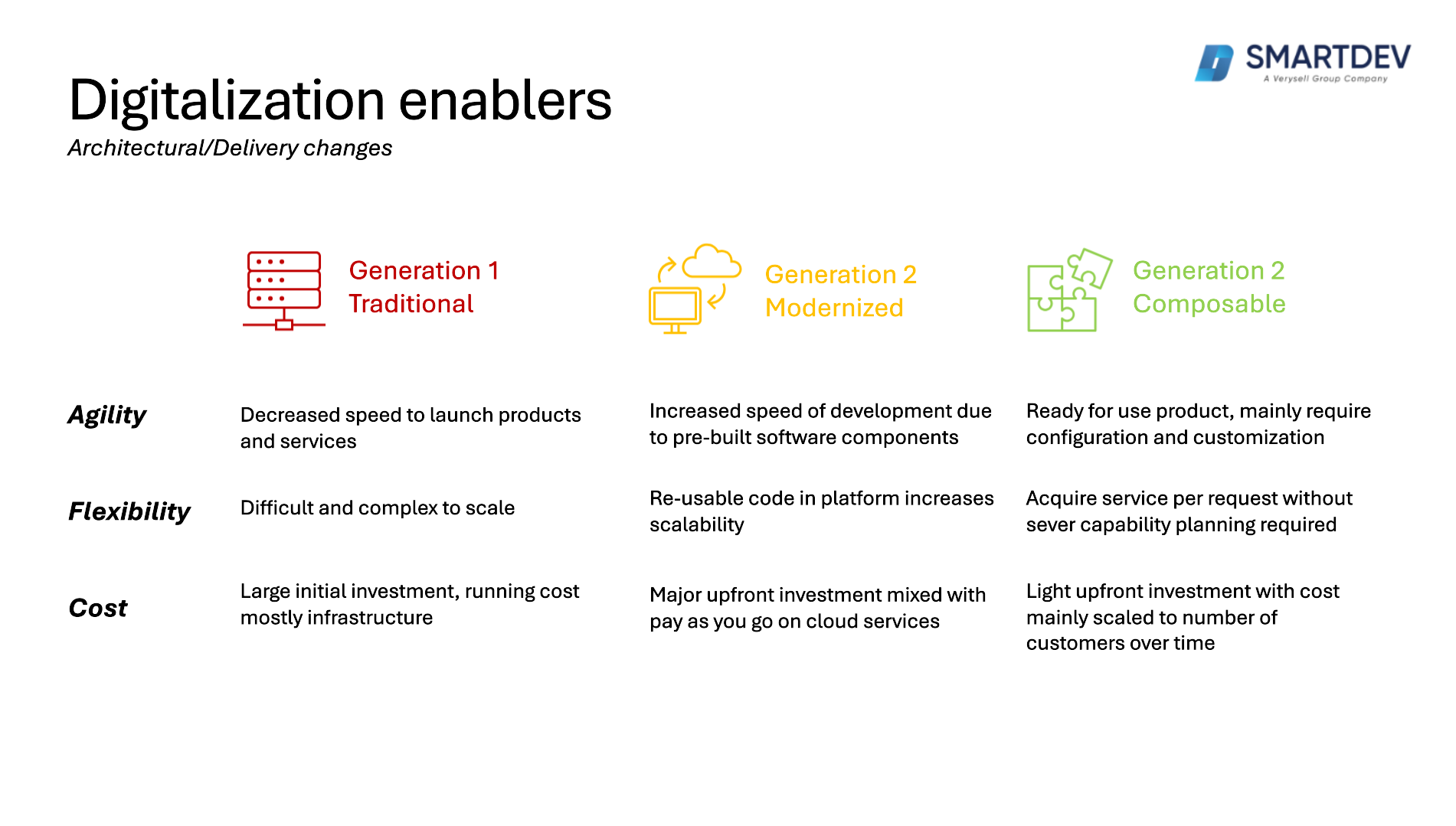

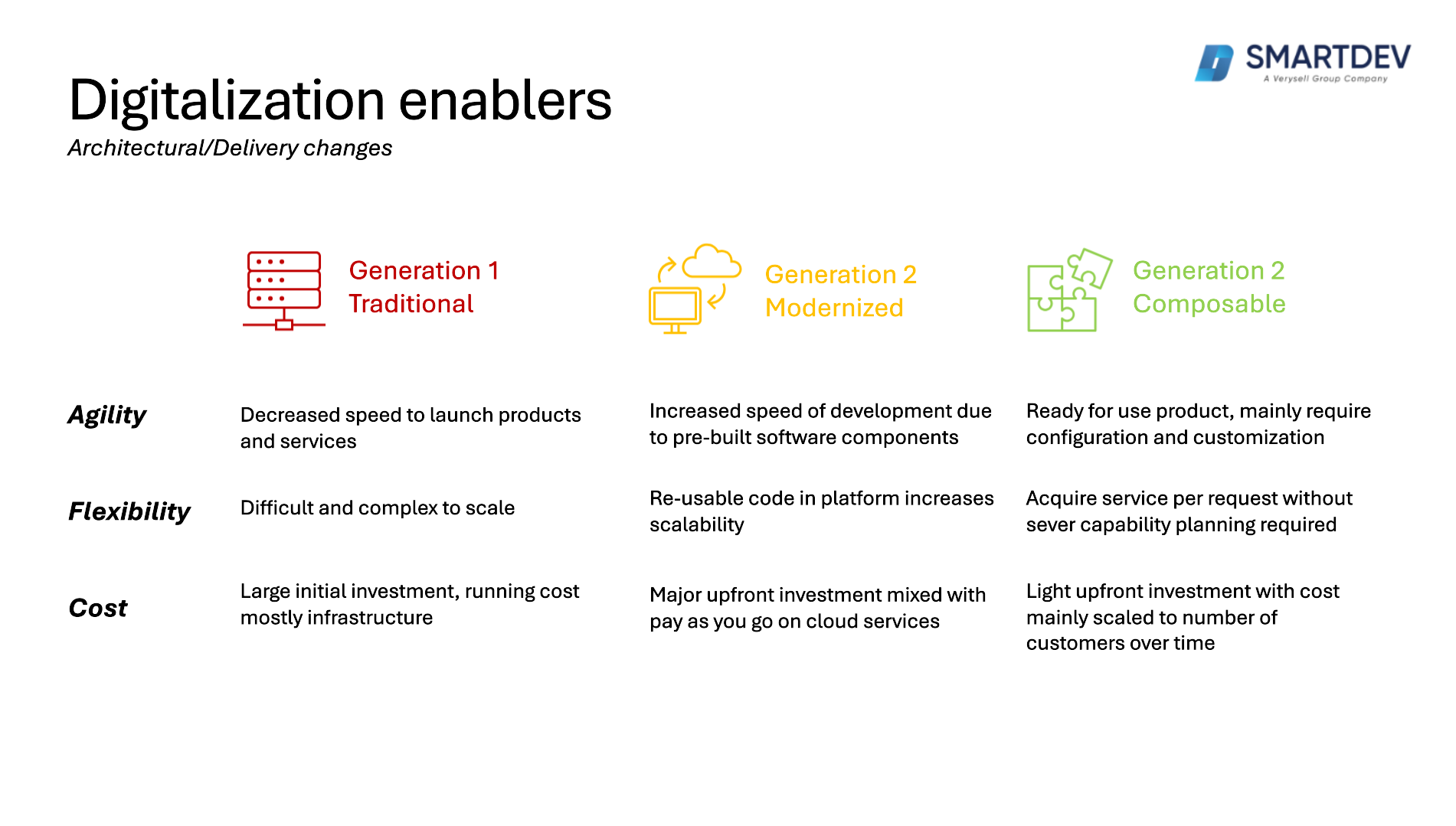

Digitalization enablers are pivotal in facilitating transformative changes in delivery mechanisms within the banking sector. These enablers, including advanced cloud technologies, robust cybersecurity measures, and agile IT infrastructures, support the seamless integration of digital services. By leveraging these foundational elements, banks can efficiently transition from traditional models to innovative digital platforms, ensuring faster service delivery, increased scalability, and enhanced data security.

Figure 7: Delivery Changes with Digital Enablers

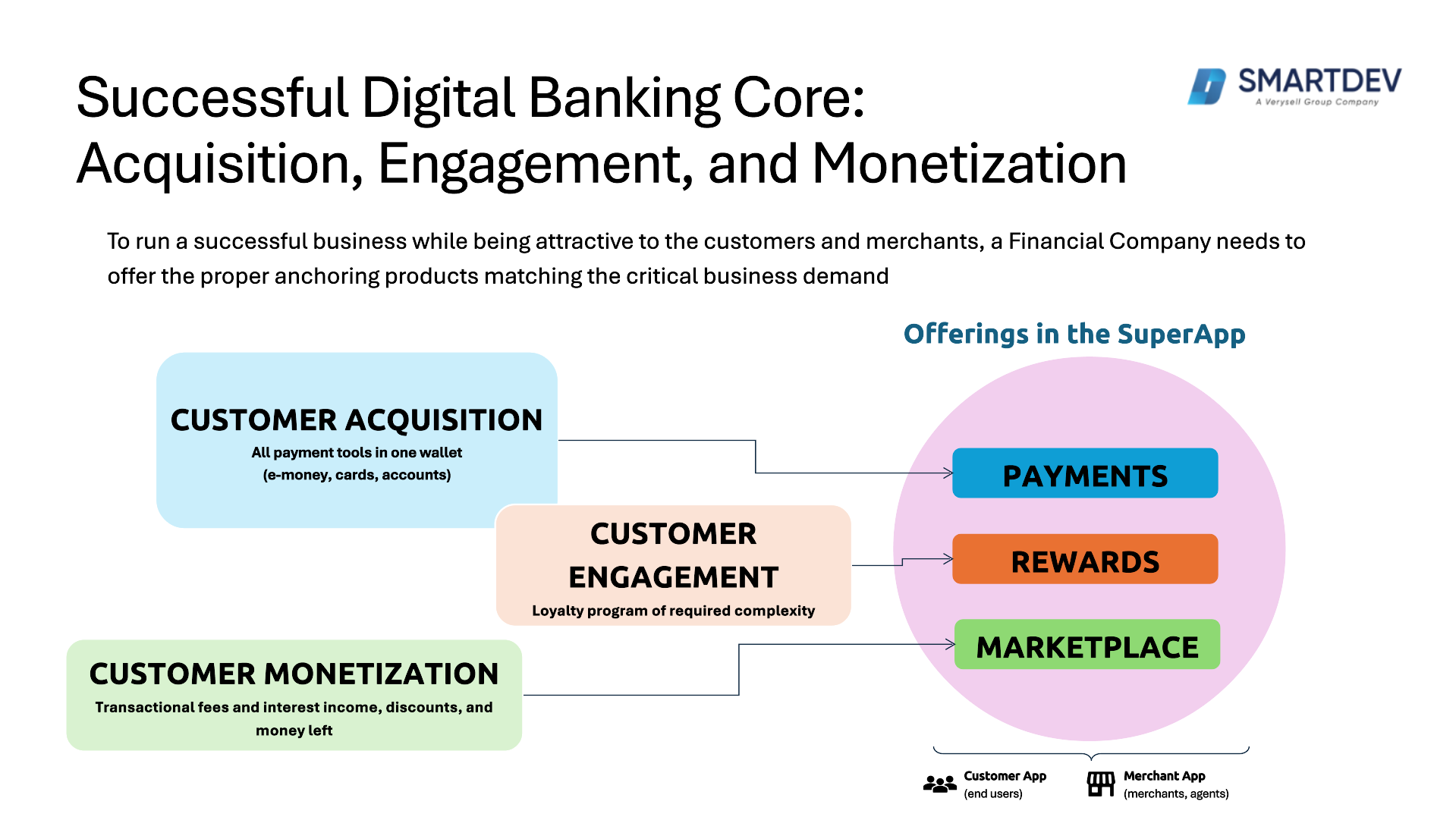

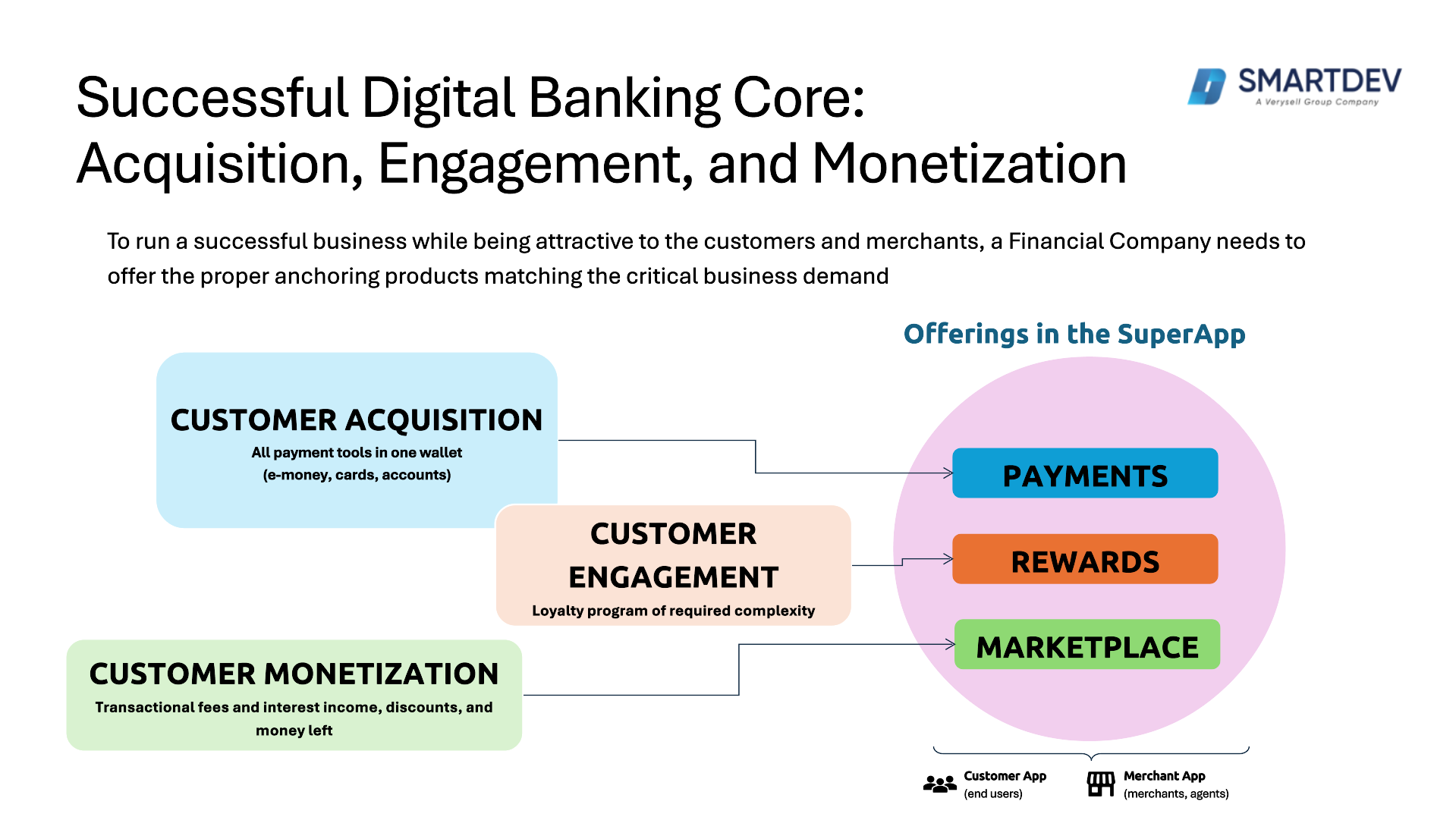

Successful Digital Banking Core: Acquisition, Engagement, and Monetization

During the webinar, Yurii highlighted that three crucial pillars—acquisition, engagement, and monetization—are essential for running a successful mobile application, drawing on his extensive experience of over 15 years.

📌 Acquisition involves strategies to attract new customers through digital channels, leveraging targeted marketing techniques and streamlined online onboarding processes that emphasize ease and speed.

📌 Once acquired, engagement strategies focus on keeping customers active and satisfied, utilizing personalized services, user-friendly app design, and interactive features that enhance the digital banking experience.

📌 Monetization involves converting this engagement into revenue through innovative financial products, premium services, and cross-selling opportunities.

Together, these three pillars ensure that digital banks not only attract but also retain and profit from their customer base in a competitive market.

Figure 8: The Core of Successful Digital Banking

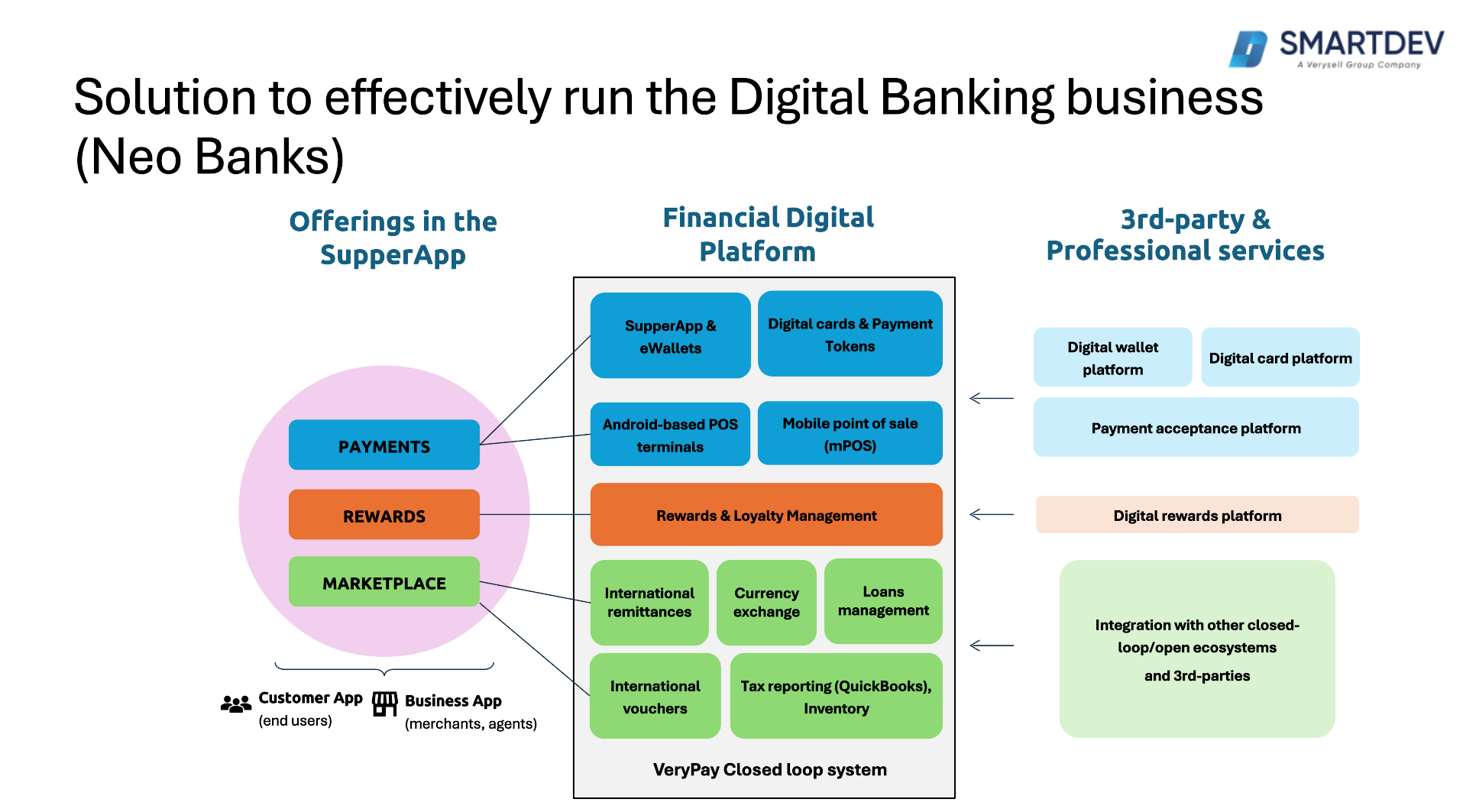

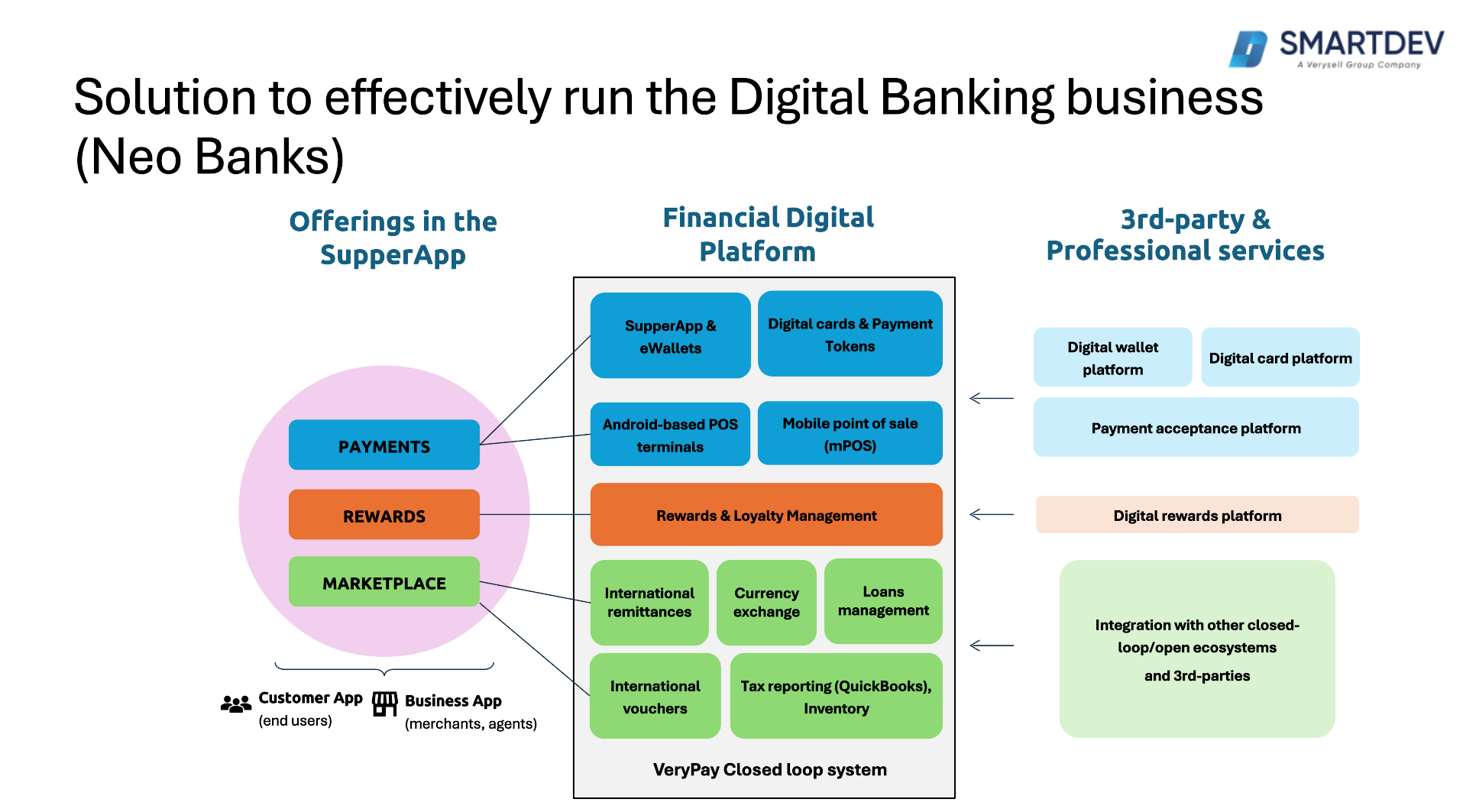

The Effective Strategy for Managing a Successful Digital Banking Business

The VeryPay team has developed a comprehensive strategy tailored to guide institutions through the complexities of the digital banking landscape. This strategy emphasizes a methodical approach to acquisition, engagement, and monetization, ensuring that digital banks not only attract but also retain and profit from their customer base. By integrating cutting-edge technologies, adopting customer-centric practices, and leveraging data-driven insights, the strategy offers a robust framework for achieving sustained growth and securing a competitive advantage in the rapidly evolving financial sector.

Figure 9: Solution for successful Digital Banking Business

A perfect IT Partner for the Banking Sector

Figure 10: SmartDev – A Perfect IT Partner for the Banking Sector

Specializing in digital transformation, SmartDev supports banks in navigating the complexities of integrating new technologies and optimizing existing systems to stay competitive in a rapidly evolving financial landscape. Our services range from developing secure and scalable banking applications to implementing robust cybersecurity measures and data analytics tools, ensuring banks can leverage the latest advancements to enhance their operations and customer service.

By partnering with SmartDev, banks can leverage the latest technological advancements to drive growth, enhance customer satisfaction, and ensure compliance with industry standards, making them a perfect IT ally in the digital age.

🚀 Stay ahead of the curve by following our Linkedin to receive updates on our upcoming webinars and learn how to navigate the digital banking landscape effectively.

Missed the webinar? Watch a recording of our “Digitalization in Banking” webinar here or visit webinar page to view our past webinar events.