Overview

Asset management stands at the core of the financial sector, encompassing a range of activities aimed at maximizing returns on investment while minimizing risk. With the rapid advancements in technology, particularly in the realm of machine learning (ML), the landscape of asset management is undergoing a profound transformation. Machine learning holds the promise of revolutionizing traditional practices, offering unprecedented insights and efficiencies. In this blog post, we’ll explore the transformative potential of machine learning in asset management, drawing on insights from academic research. Our discussion is informed by recent studies such as ‘Asset Management in Machine Learning: State-of-research and State-of-practice’ by Idowu, Strüber and Berger (2022) as well as other relevant scholarly works in the field.

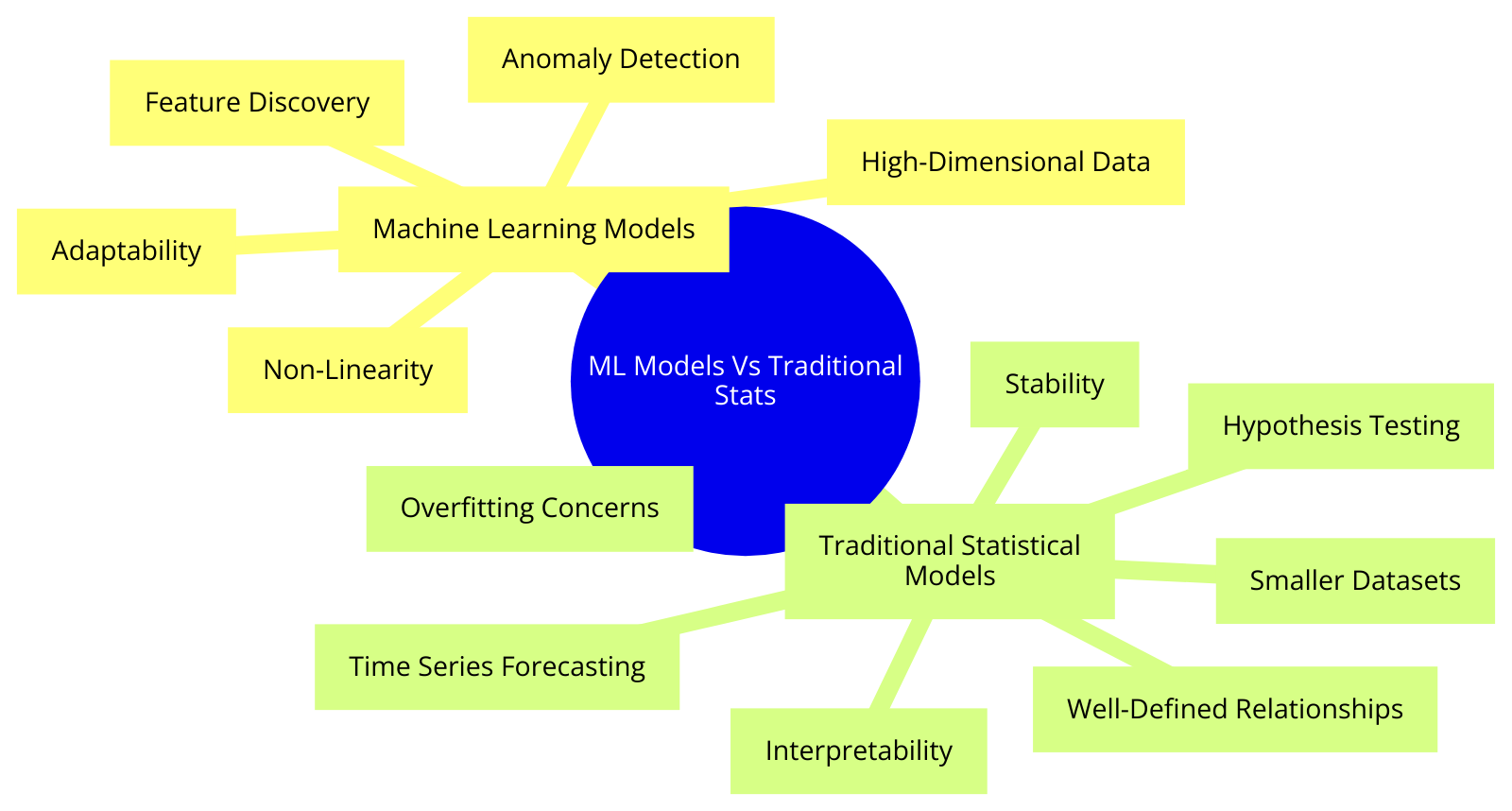

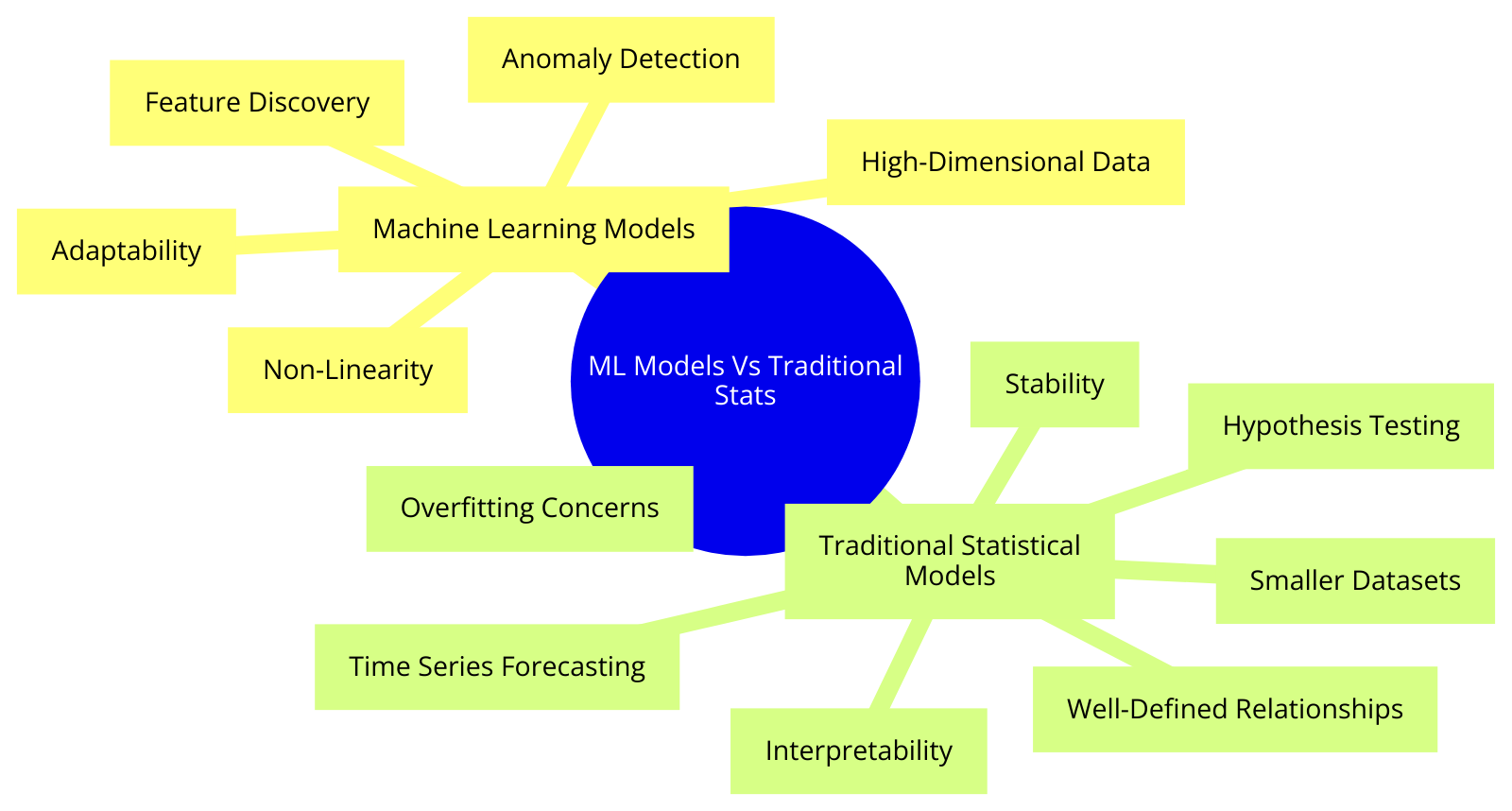

Traditional Asset Management vs. Machine Learning-Enhanced Asset Management

In traditional asset management, decisions are typically made based on historical data, market trends, and human expertise. However, this approach is constrained by inherent human biases, time-consuming analysis processes, and limited capacity to efficiently process vast amounts of data. Statistical analysis of historical data may offer insights, but it often falls short in capturing complex market dynamics and anticipating future trends accurately.

Conversely, machine learning (ML) in asset management revolutionizes decision-making by leveraging advanced algorithms to analyze large datasets, identify intricate patterns, and make predictions with unprecedented accuracy and speed. This graphical representations of comparative analyses vividly illustrate the contrast between traditional asset management and ML-enhanced approaches.

Comparative analysis reveals that ML-enhanced asset management enables more informed decision-making, enhances risk management capabilities, and ultimately delivers superior portfolio performance. By harnessing the power of ML algorithms, asset managers can uncover hidden insights, adapt to changing market conditions more effectively, and capitalize on emerging opportunities with greater agility.

Key Features of Machine Learning in Asset Management

Machine learning brings several key features to asset management tools, including enhanced reproducibility, reliability, and consistency in investment strategies. According to research conducted by Idowu et al. (2022), machine learning algorithms contribute to the reliability and consistency of investment strategies by automating tasks such as data analysis, portfolio optimization, risk management and continuous learning and adaptation.

Let’s explore this further:

- Data Analysis Automation: Machine learning algorithms can automate the process of analyzing vast amounts of financial data, including historical market trends, company financials, economic indicators, and news sentiment. Traditional data analysis methods often rely on manual processing and interpretation, which can be time-consuming and prone to human error

- Portfolio Optimization: Machine learning algorithms excel at optimizing portfolio allocations by considering multiple factors, including asset correlations, risk tolerance, investment objectives, and market conditions. These algorithms can dynamically adjust portfolio weights in response to changing market dynamics, ensuring that investment strategies remain adaptive and robust over time.

- Risk Management: Machine learning algorithms enable investment firms to model and quantify various types of risk, including market risk, credit risk, and operational risk. By analyzing historical data and identifying risk factors, machine learning models can provide more accurate risk assessments and support informed decision-making in portfolio construction and asset allocation.

- Continuous Learning and Adaptation: One of the key advantages of machine learning algorithms is their ability to learn and adapt over time. By continuously analyzing new data and feedback, these algorithms can improve their predictive accuracy and effectiveness, leading to more reliable and consistent investment strategies. This iterative learning process enables investment firms to stay ahead of market trends, adjust to changing conditions, and capitalize on emerging opportunities.

- Other real-world examples, such as the use of neural networks for stock price prediction demonstrate the effectiveness of ML in improving investment outcomes. A seminal paper that explores the application of neural networks for stock price prediction is ” The applications of artificial neural networks, support vector machines, and long–short term memory for stock market prediction” (Chaajer, Shah and Kshirsagar, 2021). In this paper, the authors demonstrate how neural networks can be trained to analyze historical stock market data and make predictions about future price movements.

Challenges in Integrating Machine Learning with Asset Management

Despite its potential, integrating machine learning into asset management practices poses several challenges. As highlighted in the study by Idowu et al. (2022), challenges in asset management for machine learning components include the lack of standardized methods, complexity in managing multiple asset versions, collaboration difficulties and lack of explicit tooling support.

- Lack of Standardized Methods: Integrating machine learning models into asset management workflows often encounters difficulties due to the absence of standardized methods. Each organization may have its own approach to model development, deployment, and evaluation, leading to inconsistencies and inefficiencies. Establishing industry-wide standards for model development and evaluation can promote interoperability and facilitate knowledge sharing among practitioners.

- Collaboration Difficulties: Collaboration between data scientists, finance professionals, and other stakeholders is essential for successful integration of machine learning into asset management practices. However, differing priorities, communication barriers, and siloed workflows can hinder collaboration efforts. Establishing effective communication channels, cross-functional teams, and collaborative tools can foster a culture of collaboration and knowledge sharing within organizations.

- Lack of Explicit Tooling Support: Asset management for machine learning components often lacks explicit tooling support tailored to the specific needs of practitioners. Existing tools may be generic or lack the functionality required for managing machine learning assets effectively. Developing specialized tooling and platforms that cater to the unique requirements of asset management for machine learning can improve efficiency and effectiveness in model development, deployment, and monitoring.

- Addressing these challenges requires the development of standardized protocols, robust data management systems, and effective communication channels. Potential solutions include the adoption of industry-wide standards, the use of cloud-based platforms, and interdisciplinary collaboration between data scientists and finance professionals.

State-of-the-Art Tools in Machine Learning for Asset Management

In the landscape of asset management, the integration of machine learning is driving a profound transformation, evident in the adoption of state-of-the-art tools by industry leaders. According to (Ucoglu, 2020), prominent audit firms such as PwC, Deloitte, EY, and KPMG have developed a suite of advanced machine learning tools. These tools are utilized for streamlining audit coordination and management, automating specific audit tasks (particularly in areas like cash auditing), conducting data analysis, assessing risk, and extracting information from documents. These appointments signify a recognition of the pivotal role that machine learning plays in optimizing decision-making processes and gaining a competitive edge in the market. Moreover, the evolving landscape of professional qualifications underscores the importance of AI expertise in the financial industry. Moreover, since 2019, aspiring chartered financial analysts are required to demonstrate proficiency in AI to attain this coveted distinction. This requirement reflects the industry’s recognition of the transformative potential of machine learning in asset management and underscores the growing demand for professionals who can effectively leverage these advanced tools.

Practical Application and Case Studies

In the dynamic realm of investment management, the integration of machine learning (ML) has emerged as a pivotal driver of innovation and efficiency, as exemplified by leading firms such as MAN AHL, New York Life Investments, and Goldman Sachs (Smart Solutions, 2021).

- MAN AHL

MAN AHL, renowned for its active trading across various hedge funds and investment strategies, leverages ML to enhance both trading strategies and execution efficiency. By developing algorithms that generate trades and optimize trade execution processes, MAN AHL has achieved notable success in extending alpha and diversification in its portfolio.

- New York Life Investments

Similarly, New York Life Investments, tasked with managing assets for a global player like New York Life Insurance Company, employs ML to generate signals for quant models. Through predictive analysis and ML techniques, the company effectively tracks extensive investment portfolios, navigates large volumes of market data, and enhances prediction accuracy, ultimately bolstering the firm’s monthly outlook.

- Goldman Sachs

Furthermore, Goldman Sachs, a leading investment management firm, harnesses ML to leverage data analysis in sell-side research. By strengthening its research data strategy team and utilizing advanced analytics techniques, Goldman Sachs empowers its researchers to access relevant insights efficiently, thereby enhancing investment strategies and streamlining the research process.

These examples underscore the transformative impact of ML in investment management, from enhancing trading strategies to improving decision-making processes and generating meaningful insights to drive investment success.

The Future Outlook

Machine learning is poised to become a game changer in asset management, offering unparalleled opportunities for growth and innovation. As ML technologies continue to evolve, asset managers must adapt to remain competitive in the dynamic financial landscape. The future of asset management lies in the continued research and adoption of advanced ML tools, driving efficiencies, mitigating risks, and maximizing returns for investors.

The integration of machine learning (ML) technologies by SmartDev

At SmartDev, a leading provider of financial technology solutions, we have made significant strides in leveraging machine learning to revolutionize asset management practices. Recognizing the transformative potential of ML technologies, our company has integrated them into its platforms to empower asset managers with cutting-edge tools and insights. Through this integration, SmartDev enables its clients to tap into the power of data-driven decision-making, gaining valuable insights from vast amounts of financial data. By utilizing ML algorithms, SmartDev’s platforms can analyze market trends, identify investment opportunities, and optimize portfolio strategies with precision and efficiency. This adoption of ML technologies equips asset managers with the tools they need to navigate the complexities of modern financial markets and stay ahead of the curve in asset management. Our commitment to innovation and technology-driven solutions underscores its dedication to empowering clients with the resources they need to thrive in an increasingly competitive landscape.

Ready to revolutionize your asset management practices? Contact SmartDev today to discover how our cutting-edge machine learning solutions can empower you with valuable insights and optimize your investment strategies!

References

Chaajer, P., Shah, M. and Kshirsagar, A. (2021). The applications of artificial neural networks, support vector machines, and long-short term memory for stock market prediction. Decision Analytics Journal, 2, p.100015. doi:https://doi.org/10.1016/j.dajour.2021.100015.

Idowu, S., Strüber, D. and Berger, T. (2022). Asset Management in Machine Learning: State-of-research and State-of-practice. ACM Computing Surveys, 55(7). doi:https://doi.org/10.1145/3543847.

Smart Solution(s). (2021). Case Studies of Asset Management Firms Successfully Leveraging On Machine Learning. [online] Available at: https://www.smarts.sg/post/case-studies-of-asset-management-firms-successfully-leveraging-on-machine-learning [Accessed 11 Apr. 2024].

Ucoglu, D. (2020). Current machine learning applications in accounting and auditing. Pressacademia, 12(1), pp.1–7. doi:https://doi.org/10.17261/pressacademia.2020.1337.